When a couple decides to legally separate, they may be unsure of their legal obligations to one another under the new status. Unlike in a divorce, spouses who are legally separated are still married, though they will also have a larger degree of financial independence compared to when the marriage was still intact. However, much like in a divorce, one spouse may be obligated to pay spousal support to the other while living apart.

The same factors that could cause one member of a couple to receive spousal support payments in a divorce also apply to legal separation in California. Understanding when support is likely to be awarded can help spouses better anticipate the financial effects of legal separation and plan for the future.

- Legal Separation and Alimony in California

- Alimony Factors in California

- Legal Separation and Determining Duration of the Marriage

———————————————————————————————————————————————————————

Need Help Figuring Out If You’re Required to Pay Spousal Support During A Separation?

———————————————————————————————————————————————————————

Legal Separation and Alimony in California

In California, alimony, also known as spousal support, is a payment made from one spouse to another to help them cover their monthly living expenses. While the stereotype for alimony has a husband invariably making payments to a wife, spousal support is, in fact, gender-neutral; either party may be required to pay support to the other, depending on their relative financial situations. As in divorce, a judge can make a spousal support order in a legal separation case, both before a final judgment is made and as part of the judgment made at the end of the case. (In other states, this type of payment made during a legal separation may be known as separate maintenance.)

There are two types of spousal support in California: temporary spousal support and permanent spousal support. Contrary to what the names might seem to imply, these terms do not refer to the length of time support is to be paid.

- Temporary support is alimony that is paid while a case is still pending and before a final order or agreement has been reached. A spouse in need of financial support can request a temporary support order as soon as a divorce or legal separation case has been filed.

- Permanent (or long-term) spousal support refers to the support order determined at the end of the case. Again, “permanent” does not necessarily mean support will be owed indefinitely. The amount and length of a spousal support order depends on a number of circumstances laid out by law that can intersect in complex ways.

Instead of making assumptions, it is best to consult with a knowledgeable family law attorney who can provide guidance on what might be expected based on your individual circumstances.

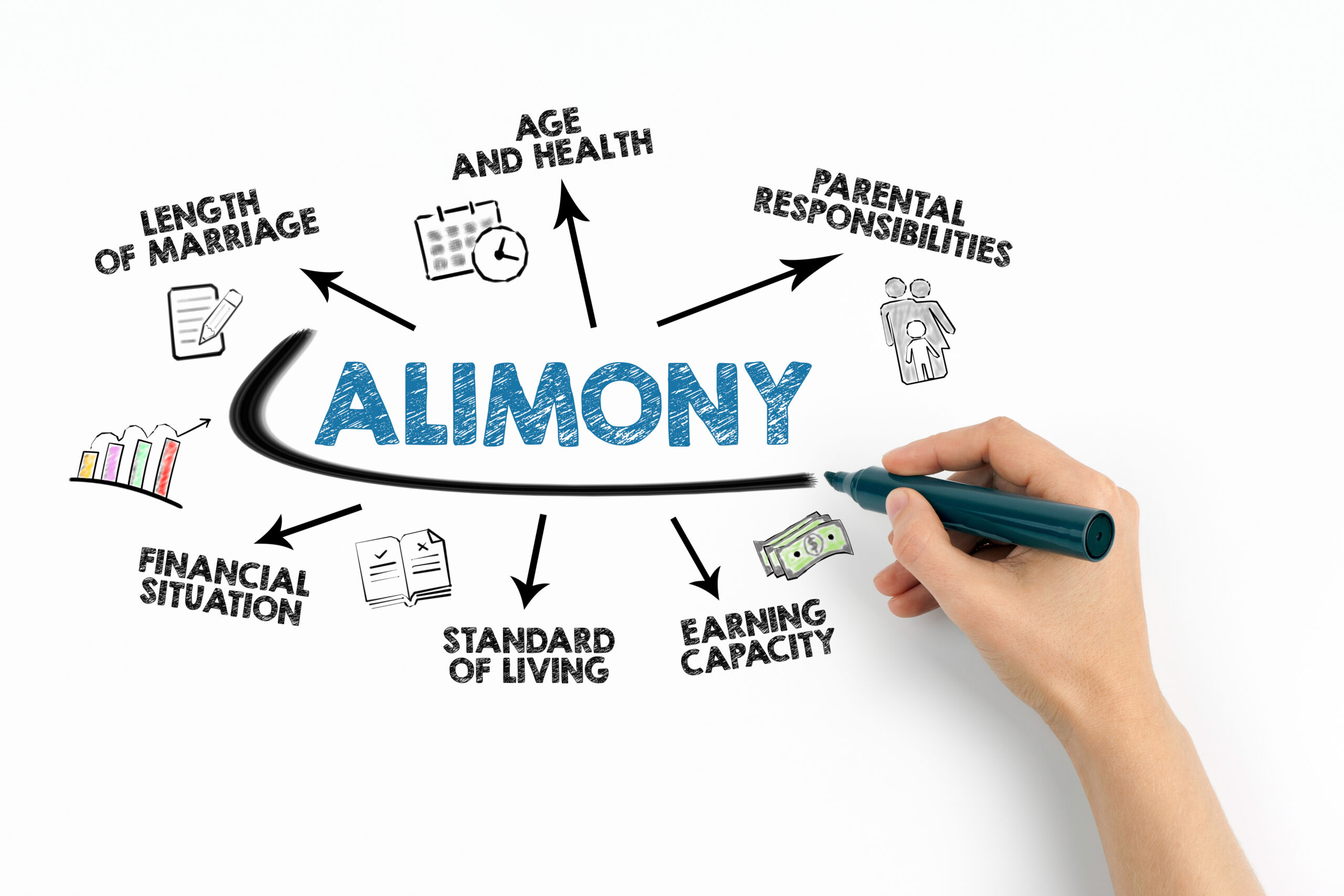

Alimony Factors in California

During a legal separation, spouses divide their finances in a similar fashion to the way they would during a divorce, though they may not sell shared assets, such as a family home. When they are no longer sharing income, it may be the case that one spouse has insufficient income to support themselves, especially if they are unemployed or have taken a long time out of the workforce to take care of the couple’s children. California Family Code § 4320 states that in ordering spousal support, the court considers it to be “the goal that the supported party shall be self-supporting within a reasonable period of time.” However, it also considers “the extent to which the earning capacity of each party is sufficient to maintain the standard of living established during the marriage.” This makes it more likely that where there is a significant disparity in income and/or prospective earning ability, the higher earner will be expected to pay support.

Beyond present income, the court looks at a wide range of circumstances that can affect each spouse’s financial situation. They will consider questions including (but not limited to):

- Will the lower-earning spouse require education or training to get a job?

- Have their career prospects been hurt by long periods away from the workforce because they were caring for children, the home, or other family members?

- Did the lower-earning spouse help the higher-earner obtain their education, job training, or a professional license?

- How old are the spouses?

- How long have they been married?

- Does either have a health condition that limits their ability to work?

- Is there a history of domestic violence in the relationship?

It’s worth noting that the court also reserves the right to consider “any other factors the court determines are just and equitable,” which makes any decisions regarding support highly individual to each situation. Again, it is best to talk to a lawyer about your financial circumstances to get a better understanding of what might apply in your case.

Legal Separation and Determining Duration of the Marriage

In California, a marriage of ten years or more (from the date of marriage to the date of separation) is considered to be of “long duration”, giving the court indefinite jurisdiction in matters of spousal support for divorce or legal separation. However, Family Code § 4336 also specifies that the court “may consider periods of separation during the marriage in determining whether the marriage is in fact of long duration.” Thus, if a couple legally separates before the ten-year mark, that may (but won’t necessarily) affect the determination of whether their marriage is considered to be of long duration if they later decide to divorce.

Your Family Law Resource in Silicon Valley

Legal separation may provide a needed “middle ground” for couples who aren’t sure if divorce is the right step, but that’s not to say that it never carries significant financial obligations. If you need help figuring out if you’re required to pay spousal support during a separation, the knowledgeable family law attorneys at Hoover Krepelka LLP can help. We’ll walk you through what you need to know to make the best decision in your situation. To schedule a consultation, fill out the form below today.

———————————————————————————————————————————————————————

Contact Us

"*" indicates required fields