When a couple gets divorced, settling the financial details and dividing the assets they accumulated during marriage can be one of the most contentious and difficult parts of the process. In addition, one spouse may seek spousal support (also known as alimony), especially when the marriage has lasted a long time or one spouse earns considerably more than the other. If you’re wondering if you are eligible to receive or may be required to pay alimony after divorce in California, here are some things you should know.

- The Purpose of Spousal Support in California

- California’s 10-Year Marriage Rule: Fact or Fiction?

- Factors That Determine the Length of Spousal Support

- What Might Change or End Spousal Support?

Is Your Marriage Dissolving & You’re Unsure Of What Divorce Will Mean For You Financially?

The Purpose of Spousal Support in California

In California law, spousal support is intended to prevent the lower-earning spouse from becoming financially destitute as a result of divorce and to provide the assistance they need to maintain their standard of living until they can become self-supporting. Ideally, such support is just a bridge that allows the spouse receiving the payments to eventually become financially independent. The court will analyze a complex set of factors to determine if support is appropriate and if so, for how long.

There isn’t a fixed set of alimony eligibility criteria that can predict how much or how long spousal support might last—it’s best to consult an experienced family law attorney to get insight on your individual circumstances. However, it is more likely that support will be required for a long period of time or indefinitely if the court determines that it will be impossible for the lower-earning spouse to earn enough to support themselves without help.

California’s 10-Year Marriage Rule: Fact or Fiction?

There’s a popular misconception California has a “10-year rule” stating that if you’ve been married ten years or more, any spousal support awarded after divorce will continue permanently. It does not help that spousal support awarded at the end of a divorce case is called “long-term” or “permanent” support (as opposed to “temporary” support, which is support paid while a family law case is in progress).

It is definitely not true that any time threshold automatically means support must be paid forever. However, the ten-year mark does have significance in state law with implications for spousal support duration. According to California Family Code § 4336, “the court retains jurisdiction indefinitely in a proceeding for dissolution of marriage or for legal separation of the parties where the marriage is of long duration.” The statute presumes that a marriage of ten years or more meets the definition of “long duration.”

In general in California, for marriages of under ten years, support can last up to half of the length of the marriage. However, in marriages of over ten years, the court makes no assumption of what length of time would be reasonable for support to continue and will look at many factors to make an individual determination in each case. The length of the marriage is determined by the time from the date of marriage to the date of separation, not to when the divorce is finalized. The date of separation, for example, could be the day one spouse moved out, or when both parties agreed that their marriage was over and started making plans to divorce. Another important caveat is that the court has the discretion to decide a marriage is of long duration even if it didn’t make it to the ten-year mark.

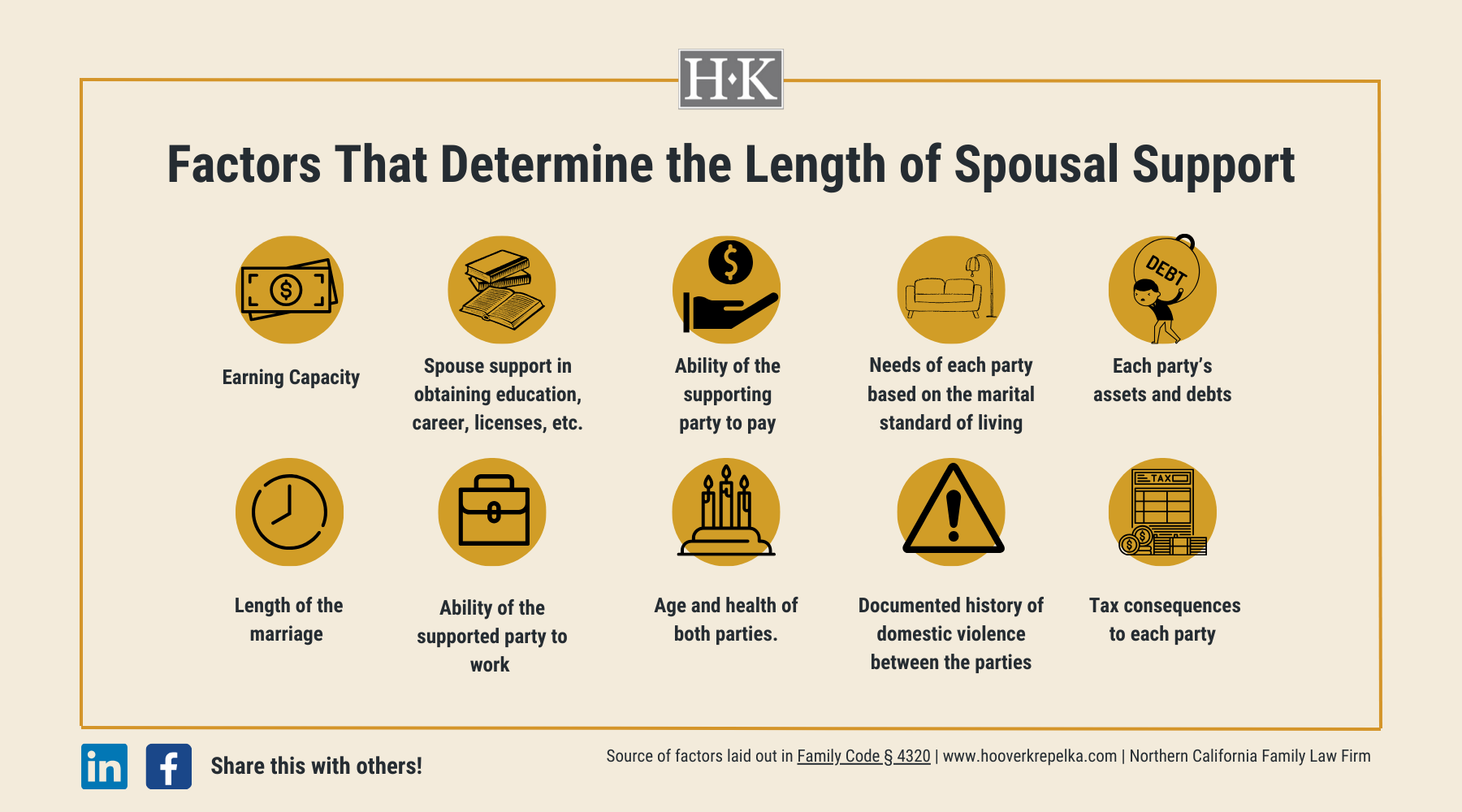

Factors That Determine the Length of Spousal Support

If one party is requesting long-term spousal support, the court will consider a set of factors laid out in Family Code § 4320, including:

- Whether the earning capacity of each party is enough to maintain the standard of living established during their marriage.

This takes into account the marketable skills of the supported party and how much time/money it would cost for education or training to develop those skills or acquire other marketable skills/employment, as well as the degree to which the supported party’s earning capacity has been harmed by periods of unemployment due to taking care of the marital home and family.

- Whether the supported party helped the supporting party get an education, training, career, or professional license.

- The ability of the supporting party to pay, given their earning capacity, income, assets, and standard of living.

- The needs of each party based on the marital standard of living.

- Each party’s assets and debts.

- The length of the marriage.

- The ability of the supported party to work without unduly impeding their ability to take care of children in their custody.

- The age and health of both parties.

- Any documented history of domestic violence between the parties or against either party’s child.

- The tax consequences to each party.

What are circumstances that might make it more likely for spousal support to be awarded for a longer period? For example, if the lower-earning spouse took a considerable time out of the workforce to raise children and the divorce is taking place close to a normal age of retirement, it’s unlikely they would be able to make up the lost ground in their career to meet the marital standard of living or maybe even come close to becoming self-supporting. Another possibility might be if the spouse seeking support is disabled and cannot work full-time. Again, there are no set rules or formulas for determining how the court weighs the various factors to be considered when determining spousal support.

What Might Change or End Spousal Support?

Even if spousal support has been ordered to continue long-term, there are points at which it can change or end. If the supporting party’s income decreases to the point where the level of support ordered is no longer feasible, they can request a spousal support modification to lower or terminate payments. If the party receiving support achieves financial independence either through a windfall or career advancement, a modification can also be requested. Additionally, unless there is a written agreement otherwise, remarriage of the supported party or the death of either party automatically ends spousal support obligations.

Family Law Experts Providing Insight into Spousal Support

If your marriage is dissolving and you’re unsure of what divorce will mean for you financially, the experienced family law attorneys at Hoover Krepelka can help provide you guidance and advocate for your rights. To get answers to your questions about spousal support, fill out the form below to schedule a consultation with our attorneys.

"*" indicates required fields