When couples are getting divorced, a great deal of thought and effort often goes into dividing up the financial assets they have accumulated over the course of the marriage. However, they should also consider divorce tax implications of the decisions they make, as these can potentially result in unanticipated tax liability down the road, or, conversely, reduce the payment of unnecessary taxes.

It is best to consult with a qualified financial professional such as a tax accountant or CPA, in conjunction with your family law attorney, to fully analyze your particular situation and make recommendations as you are negotiating your divorce settlement. However, to give you an idea of the issues that commonly come up, here are some divorce tax implications to consider.

- Filing Status on Your Tax Return

- Children: Support and Exemptions

- Spousal Support

- Capital Gains

- Retirement Accounts

Need Assistance In Protecting Your Financial Future After A Divorce?

Filing Status on Your Tax Return

If you are in the process of getting divorced but are still legally married as of the end of the tax year (December 31), you may elect to file jointly rather than file separate tax returns for the year in question, even if you are physically separated at the time. Both spouses must agree in order to do so.

There can be advantages to this approach—in general, your overall taxes will tend to be lower, and filing jointly means not having to figure out how to divide deductions, income, etc. while you are likely still working out the details of who will get what. However, there may be disadvantages as well. When you file jointly, you and your spouse are both liable for that tax return, meaning the IRS could come after you for unpaid taxes if your ex fails to pay their share.

In addition, should the return be audited down the road, you may end up having to deal with it together years after the divorce is finalized. In short, if you are not confident your spouse is completely aboveboard with their tax reporting, or you’re in a contentious divorce, the risks of joint filing may outweigh the possible benefits.

If the divorce has been finalized before the end of the tax year, then you will need to file as either “single” or “head of household.” While filing as head of household tends to lower your tax rate, you must meet certain criteria, including having at least one child or dependent (this is to account for people who are able to file as HH claiming dependents other than children of the marriage, i.e., a parent or other family member) in your care for more than fifty percent of the year. Again, working with a knowledgeable tax professional is recommended to ensure accurate filing.

Children: Support and Exemptions

Child support, under both federal and California law, is not tax deductible for the parent paying it; nor is it considered taxable income for the parent receiving it. Claiming a child as a dependent, however, can reduce your taxes by allowing you to claim head of household status, the child tax credit, and other tax benefits (note that the Tax Cuts and Jobs Act of 2017 (TCJA) raised the standard deduction but eliminated deductions for dependents through 2025). Only one parent can claim the child as a dependent, usually the one the child lives with most of the year.

It is possible for the noncustodial parent to claim a child as a dependent for the child tax credit if they file Form 8332, signed by the custodial parent, with their tax return. Couples may agree to alternate taking this credit on their tax returns as part of a divorce agreement or assign it to the noncustodial parent. Whatever the arrangement, spelling out who gets tax credits when explicitly can help avoid conflict and confusion in the future.

Spousal Support

Another change the TCJA introduced was in the tax treatment of spousal support/alimony payments at the federal level. For spousal support orders or judgments completed before January 1, 2019, these payments were tax deductible for the payor and were reportable as income by the payee. Orders after that date are now treated like child support for federal tax purposes (i.e., not tax deductible for the payor or counted as income for the payee).

California law, however, differs. Spousal support payments can be deducted on state income tax forms, and spousal support received must be reported as income in California. To ensure you are able to take this deduction, it is important to differentiate spousal support payments from child support; if you are receiving spousal support, you should take care that your state tax withholding is sufficient to cover any additional taxes owed as a result.

Capital Gains

When it comes to dividing marital property, all assets are not created equal, and potential capital gains can be one key reason why. While the transfer of property incident to divorce is not taxable, there is no tax basis step-up due to divorce. So if, for example, you receive stocks or property that has significantly appreciated over the course of your marriage, you should factor in the amount of capital gains taxes that may be owed upon sale in determining the property’s value.

Likewise, if the marital home is sold during the divorce and the proceeds split, the capital gains tax exclusion can be up to $500,000. By contrast, if one party receives the home, their maximum exclusion as an individual is only $250,000, and a future sale may result in capital gains taxes being owed that might have been avoided.

Retirement Accounts

Dividing retirement accounts as part of a divorce settlement must be done correctly to avoid triggering unintended tax consequences. An IRA can be divided without tax if it is treated as a transfer incident to divorce in your agreement. However, accounts covered under the Employee Retirement Income Security Act (ERISA), such as a 401(k), require the use of a qualified domestic relations order (QRDO) to accomplish a similar tax-free transfer in a divorce. In either case, if the transfer is not handled properly, you may owe tax and early withdrawal penalties on the amount removed from the plan.

Need Assistance With California Divorce Tax Implications?

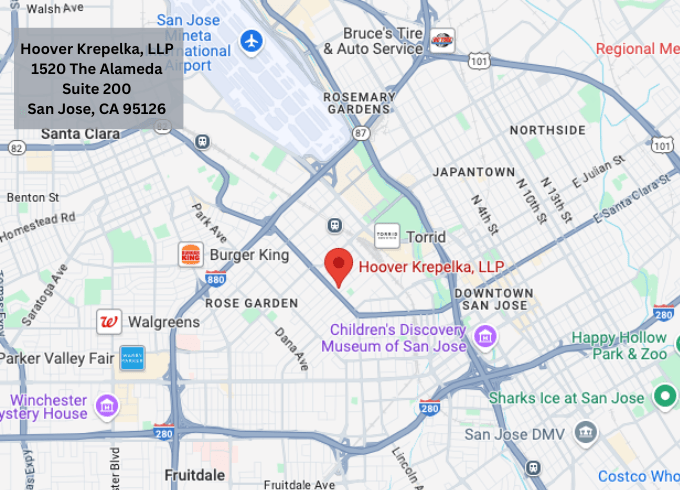

These are only some of the tax-related issues that can arise when couples are untangling their finances during a divorce. The more complicated your financial picture, the more likely it is that unforeseen tax pitfalls can have a negative impact. The family law firm of Hoover Krepelka has extensive experience with complex property division, working closely with financial professionals to devise settlements that protect our clients’ interests. We can help protect you from avoidable missteps that could harm your financial future.

Fill out the form below to schedule your consultation with an attorney.

"*" indicates required fields