Untangling your personal finances can be one of the trickiest parts of getting divorced. After years of pooling income and viewing your assets as belonging to both spouses, determining what each will walk away with when the divorce is finalized is almost never as simple as dividing everything down the middle. Having separate bank accounts at the right time can be essential in navigating the divorce process without creating undue hardship or added confusion. However, it’s essential to understand what you can and cannot do financially when you are divorcing to avoid making missteps that can have serious legal consequences. Continue reading to learn more.

- Why Separate Bank Accounts

- Separate Bank Accounts Don’t Necessarily Equal Separate Property

- What You Should and Shouldn’t Do Financially During Divorce

Concerned About Your Finances In A Divorce?

Why Should I Consider Separate Bank Accounts?

There’s long been a presumption that married couples will automatically share a joint bank account. That strategy can certainly simplify the task of understanding how much is available to pay bills, provide transparency on finances to both spouses, and make it easier to create an overall budget when partners are able to work together. The drawbacks to joint accounts become quickly evident, though, when that marriage is coming to an end.

If you don’t already have a separate bank account from your spouse prior to divorce, when should you open one? Everybody’s situation is unique, so it is best to consult an experienced family law attorney to get advice specific to your circumstances. In general, it is worth remembering that after the date of separation, each party’s income is considered separate property even though the marriage has not yet been ended legally. Couples may choose to open separate accounts upon separation to avoid depositing such separate property funds into accounts that include community property and further complicating property division in their divorce.

A more urgent reason to open a separate account can be if one spouse fears that they will be cut off financially during divorce, or if there is a history of financial abuse or domestic violence in the relationship. Opening a separate account before the divorce is initiated can protect you from immediate financial harm if you suspect your spouse might drain your joint funds or lock you out of your account to retaliate.

In any event, you should keep a full and careful record of any transactions related to separate bank accounts, whether they are initially funded with money withdrawn from a joint account or not. You will be required to disclose the existence and the balances of all accounts during the divorce process.

Separate Bank Accounts Don’t Necessarily Equal Separate Property

What happens when a couple has separate bank accounts prior to divorce? Spouses may choose to maintain separate bank accounts in marriage for a variety of reasons. For example, they may prefer the financial independence of not having to run every purchase by their spouse, or they may be trying to shield money from one spouse’s premarital debt by having it in an account under the other spouse’s name. It does not necessarily follow, though, that the money in a separate account is the separate property of the party whose name it’s under.

Unless you have a prenuptial or postnuptial agreement that specifies otherwise, anything earned while you were married but prior to separation, and anything you bought with that money, is considered community property—belonging equally to both spouses. Similarly, debt taken on by either party during the marriage is likely to be determined the the responsibility of both parties. To give a very simple example, if each spouse deposited their own salary into a separate account during the marriage, that does not mean that each gets to walk away with the money in their respective accounts when divorcing. Those accounts must be disclosed and considered along with any other separate and joint accounts and property in creating an asset division agreement/order that is equitable to both parties.

Certain assets may be considered separate property if they meet the statutory requirements to be deemed so and are not commingled with marital property. These include property you owned before you were married, as well as gifts or inheritances you received individually while married. Maintaining such funds in a separate account and very carefully tracked apart from marital property can help establish your individual right to them, but it’s more common for assets to be treated in ways that makes their current status unclear even if they started as separate property. Hiring a forensic accountant to conduct a financial inventory and asset tracing may be able to help determine if an asset still meets the criteria for separate property, based on its origin and use in the marriage.

Need Help Protecting Your High-Value Assets In A Divorce?

What You Should and Shouldn’t Do Financially During Divorce

Money is an emotional issue, and frequently people make financial mistakes through impulsive or poorly considered actions in the midst of divorce. You should consult a knowledgeable attorney as soon as possible and scrupulously follow their guidance to avoid errors that can have long-term consequences. An attorney is also essential when spouses have disproportionate incomes, as this type of financial situation tends to involve complex property division and spousal support issues that can be difficult to resolve fairly without skilled representation.

Remember, disclosure of all assets is a requirement of divorce proceedings, so a separate account is not a private account. It may be tempting to try to hide or lie about assets, but doing so will only make the process of reaching a financial settlement more contentious and damage your credibility with the court and you could possibly lose the asset in its entirety to the other party. Being transparent and hiring the necessary professionals to gain a complete understanding of your financial situation and the implications of any proposed asset division agreement will be more effective in allowing you to exit your marriage with your fair share of marital property.

Protecting Your Financial Interests in Divorce

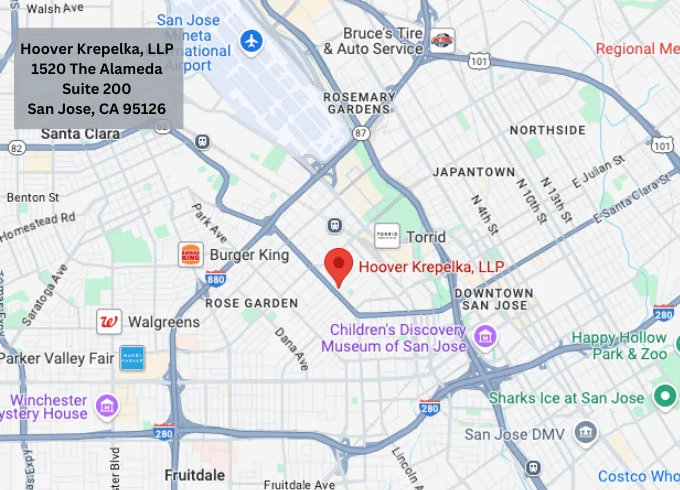

Trying to understand the financial impact of divorce can be unexpectedly complex, at a time when high emotions make it difficult to know how best to proceed. The expert family law attorneys at Hoover Krepelka are experienced in negotiating property division in the most complicated circumstances. We work diligently to protect your financial future. To schedule a consultation with an attorney, fill out the form below today.

"*" indicates required fields