When a couple decides to divorce, dividing their shared property, assets, and liabilities and determining what support obligations are appropriate are a major part of unraveling their former life together. This process is often also a major source of acrimony, especially if one spouse feels that they should be entitled to a greater share of marital property than would be allowed by law. California is a community property state, which means that in the absence of a prenuptial or similar agreement, property and debts acquired during a marriage belong to both spouses equally. This simple fact may tempt some to conceal assets in advance of filing for divorce, despite its being illegal.

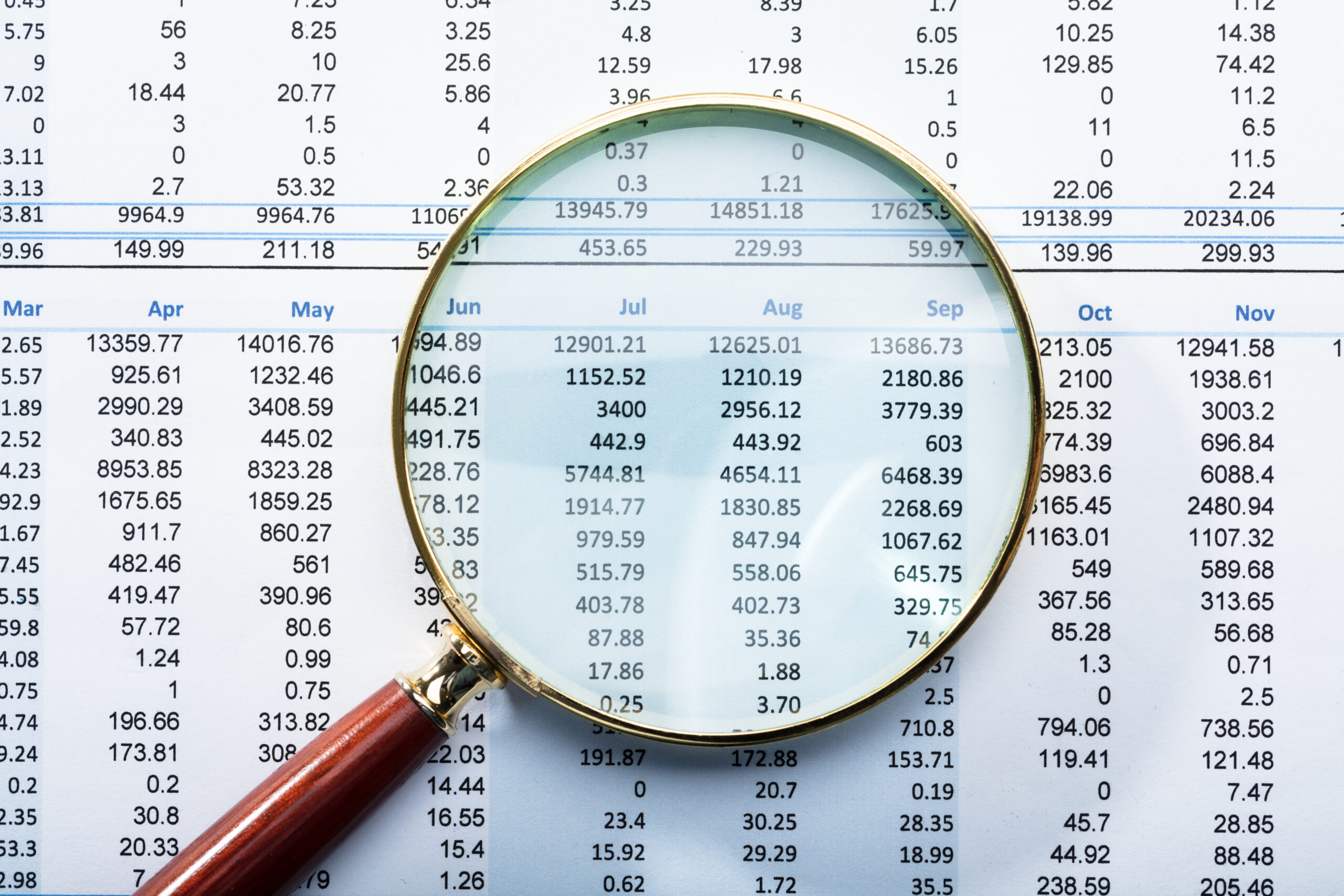

Unfortunately, the other spouse may have a hard time detecting when this has been done, especially if they lacked full access to the couple’s financial information during their marriage. In a high-net-worth situation, where complex assets are involved, there may be reams of data to wade through to try to pin down why the financial disclosure that has been presented seems to be too low, without obvious explanation. In these circumstances, a forensic accountant is invaluable in determining if assets have been hidden and how.

- What Is a Forensic Accountant?

- Professional Qualifications of a Forensic Accountant

- Techniques Used by a Forensic Accountant

Do you suspect your ex-spouse of concealing assets in a divorce?

What Is a Forensic Accountant?

A forensic accountant is a financial professional who combines accounting, auditing, and investigative skills to detect fraud, uncover financial irregularities, and piece together a complete picture of complex financial dealings when there is a suspicion of illegal or deceptive activities. These skills may be used in a variety of contexts. For example, a forensic accountant may be called in to assist law enforcement agencies in investigating cases of securities fraud, embezzlement, money laundering, or other white-collar crimes. They may also be employed by private companies to help prevent accounting malpractice, or to conduct financial reviews for high-value transactions such as mergers and acquisitions.

In the content of divorce proceedings, a forensic accountant may be brought in when there are complex asset division issues to resolve or when it is believed that one spouse may be attempting to hide assets. Full financial disclosure is a legal requirement in divorce in California, necessary to calculate both a fair division of marital property but also to establish spousal and/or child support. Thus, hidden assets can have serious long-term implications for the financial well-being of the spouse who is the victim of the deception. A forensic accountant may also be called on to distinguish separate property from marital property in circumstances where the ownership of such assets has become muddied by commingling with marital property.

Professional Qualifications of a Forensic Accountant

The career path of a forensic accountant starts out like that of regular certified public accountants (CPAs). They start with an undergraduate degree in accounting, finance, or similar fields. They may also pursue advanced degrees in accounting, business administration, or forensic accounting.

A forensic accountant will also tend to have other professional certifications that testify to their knowledge and skills. In addition to a CPA, they may also hold a Certified Fraud Examiner (CFE) credential, a Certified in Financial Forensics (CFF) credential, and/or an Accredited in Business Valuation (ABV) credential. Each of these require added study and examinations to verify their knowledge and skills in the applicable area, and some require a CPA prior to credentialing.

Techniques Used by a Forensic Accountant

A forensic accountant may use a variety of different approaches for uncovering hidden assets, depending on the exact circumstances of the couple. The goal is to put together a complete financial story, which can require scrutinizing many different types of records and documentation for clues that when put together create a full picture. Their task will generally start with examining records provided by their client such as bank account and brokerage statements, tax returns, credit card statements, and other financial documents. They may also need to examine business records if either spouse owned their own company.

What does a forensic accountant look for in these records? In a global sense, they look for details that don’t make sense in the overall context of the couple’s finances. It could be something as obvious as a transfer to an unknown account that, in essence, simply vanishes off the books. But discrepancies may be more subtle, such as a comparison between W-2 and/or K-1 income and bank deposits showing that what has been reported on tax forms isn’t matching what ended up in the couple’s accounts. Or there may be deductions for expenditures on a tax return, or royalty income, that can hint at undisclosed assets. A forensic accountant will also scrutinize transfers of assets to family and friends, or payments for “debts” that had been previously unknown or undocumented. They may also look for unusual activity in the business, such as movement of funds to outside accounts or the creation of false expenses to devalue the company.

Their analysis of what is initially provided may lead to additional avenues of inquiry that require legal action to pursue. In these instances, the forensic accountant will work with the client’s family law attorney to request the production of additional information and/or compel testimony that can provide the missing pieces to explain where diverted funds or assets have gone. They will also produce a written report and may be called on to provide oral testimony regarding their findings to the court.

Uncovering Hidden Assets in Divorce Cases

When it is suspected that one party in a divorce has taken deliberate steps to conceal assets, a forensic accountant can be invaluable for ensuring that the inventory of marital property and income necessary for a fair property division is accurate and complete. The family law attorneys at Hoover Krepelka in Silicon Valley are experienced in complex property division, and we understand when a forensic accountant is necessary to reveal the hidden truth of your financial picture. We partner with professionals selected for their expertise in family law cases and their experience in providing compelling court testimony. To schedule a consultation, fill out the form below today.

"*" indicates required fields